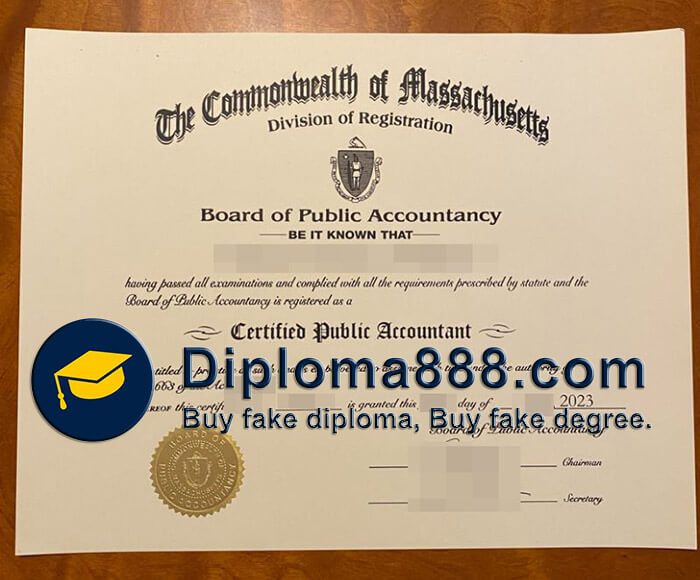

Buy fake Massachusetts CPA certificate, How to order fake Commonwealth of Massachusetts CPA certificate? Obtain replicate CPA certificate, Buy fake CPA diploma certificate from USA, Where to make a fake Board of Public Accountancy certificate? Make CPA certificate in Massachusetts.

Massachusetts CPA Exam Education Requirements:

The Certified Public Accountant certification is one of the most prestigious professional certifications available. It indicates that the accountant has satisfied a demanding set of educational, professional, and ethical standards. How to order fake York College Pennsylvania diploma? buy fake diploma, fake degree, phony certificate, buy CPA certificate in UK, buy CPA certificate in AUS, order fake CPA certificate from Canada, buy USA Certified Public Accountant certificate, Apply for a CPA Certification.

How do I become a CPA in Massachusetts?

First, you must have a bachelor’s degree or higher from a regionally accredited college or university. You must also have completed 150 semester (225 quarter) hours in various course subjects, including: 30 semester (45 quarter) hours of accounting courses covering: Financial auditing.

What is licensure cycle CPA Massachusetts?

Massachusetts CPAs must renew their CPA license by June 30th every 2 years.

But That’s Not All

In addition to completing 120 hours of education, prospective CPAs have to achieve one of the following additional requirements.

Option 1 – Earn a graduate degree in accounting from an accredited school. If the school is not accredited, it must be approved by either the National Association of State Boards of Accountancy or a credentialing committee that the Board appoints.

Option 2 – Earn a graduate degree in business administration or law from an accredited school. This must include either 30 undergraduate hours of accounting courses or 18 hours of graduate courses in accounting.

Option 3 – Earn a bachelor’s degree from an accredited school that includes 30 hours of accounting courses. Students must take courses in management accounting, taxation, auditing and financial accounting. Students also have to take 24 hours of business classes in areas other than accounting. These include information systems, finance and business law. At least one course must be in one of the following areas — professional ethics, business communication or business organizations.